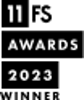

Save for your first home with the market-leading Lifetime ISA

Save up to £4,000 each year towards your house deposit and get a 25% government bonus. Open an account with just £1 or transfer today. No introductory rates, no fees.

Scan the QR code to download the app

Join 350,000 others saving for their

first home.

Watch: Tembo

LISA in under 2

mins

Already have a LISA?

Transferring to our market-leading LISA is easy, and over 5-years that simple switch would increase your deposit by hundreds versus the next best available rate. Plus, we’ll have your money transferred in as little as 4 weeks.

Open the app and select ‘No, I’ve got a LISA already’ to start your transfer.

Trusted

Rated ‘Excellent’, multi-award winning and trusted by thousands to make home happen. Tembo is also backed with investment from Aviva.

Regulated

We are authorised and regulated by the Financial Conduct Authority. Your financial wellbeing is our top priority.

Protected

Up to £85,000 of your money is eligible for protection under the Financial Services Compensation Scheme.

Secure

We encrypt and protect all data with banking-level security to keep you and your money safe.

How does it work

A Lifetime ISA is a smart way to save a deposit for your first home faster. You can open a new account if you’re between 18-39. Already have a LISA? Switch to our market-leading interest rate in under 5-minutes.

Why use a Lifetime ISA?

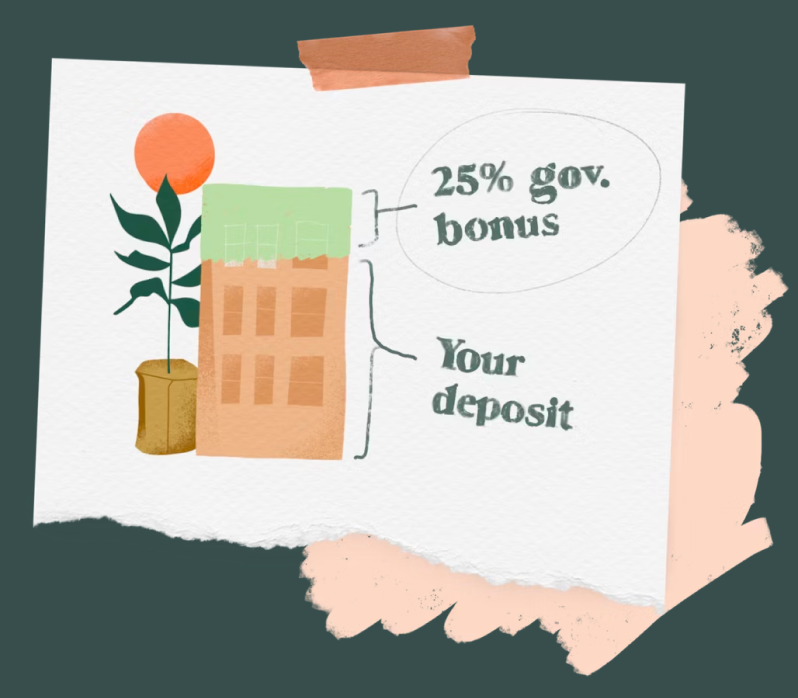

£1,000 annual bonus: Contribute the maximum £4,000 each tax year and you’ll get a 25% bonus. Or £1 extra for every £4 saved.

Tax-free benefit: The money you save or invest, plus the interest or investment gains are totally tax-free.

Save over the long-term: You can keep paying in until you turn 50, and receive a maximum bonus of £32,000.

Save or invest: Depending on your risk appetite and timeline to buy, you can choose a Cash LISA or a Stocks & Shares LISA.

Featured in

Account fees

You didn’t think we’d hide them in the small print did you? For an account with a 25% government bonus and a financial friend in your back pocket, here’s how much it’ll cost:

Cash fees

Monthly membership fee:

£0

Heads up: Tembo receives interest on the money it holds for customers. This interest isn't a fee, we just wanted to let you know.

Investing involves risk

If you open a Tembo Stocks & Shares Lifetime ISA, it’s important that you know the value of your investment could go up as well as down. You could get back less than you put in, which means it would take you longer to buy your first home. Past performance is not necessarily a guide to the future and investing is not intended to be a short-term option. We can’t and don’t provide financial advice so please be sure that investment risk is right for you.

Need to knows

When does the 4.6% rate apply from?

Who can open a Lifetime ISA?

Lifetime ISAs are designed for first-time home buyers who want to boost their house fund, or people retiring over the age of 60 who want to boost their pension. There are some other eligibility rules that apply. To open a Lifetime ISA, you must:

Be a UK resident Be between 18 – 39 years old Be a first-time buyer Buy a property in the UK, for less than £450,000 Buy with a mortgage (i.e. you can’t pay for it in full upfront) Live in the property once you buy it (no Buy to Let mortgages) Have your Lifetime ISA open for at least 12 months before you withdraw your money

🚨 IMPORTANT 🚨

If you withdraw your money for any other reason than buying your first home or for retirement once you’re 60, you’ll have to pay an early withdrawal charge of 25% to the government. This means you would get back less than you paid in, as you’d lose the government bonus and pay the government an extra £6.25 for every £100 you deposited.

Can I open a Tembo Lifetime ISA if I already have a Lifetime ISA?

Yes, absolutely. If you already have a LISA, you can transfer your funds to us to take advantage of the higher interest rate. Transferring will only take a few minutes in the Tembo app, and your money will land in the account in 4-6 weeks (depending on how speedy your old provider is!)

You can only pay into one Cash Lifetime ISA or one Stocks & Shares Lifetime ISA every tax year (April 6th to April 5th). So if you have paid into one Lifetime ISA already this tax year, but want to open and pay into another one, you can either transfer your funds to us, or wait until the new tax year begins on April 6th.

Let’s make home happen